Vietnam moves to attract higher-quality FDI flows

Under the Government’s Decree No. 236/2025/ND-CP, effective from October 15, 2025, Vietnam officially applies a global minimum tax rate of 15% on multinational enterprises with consolidated revenues of 750 million EUR (877.87 million USD) or more. This move helps the Southeast Asian nation align its tax policy with international practices, as more than 100 countries have already introduced similar measures.

Vietnam’s adoption of the global minimum tax marks a strategic step that demonstrates the country’s responsibility and proactive integration with international standards, aiming to both retain existing investors and upgrade the quality of foreign direct investment (FDI) in the years to come.

|

|

For affected investors, the Vietnamese tax authorities will collect a top-up tax to bring their total tax burden to at least 15%. |

Under the Government’s Decree No. 236/2025/ND-CP, effective from October 15, 2025, Vietnam officially applies a global minimum tax rate of 15% on multinational enterprises with consolidated revenues of 750 million EUR (877.87 million USD) or more.

This move helps the Southeast Asian nation align its tax policy with international practices, as more than 100 countries have already introduced similar measures.

In the first nine months, Vietnam licensed 2,926 new FDI projects from 82 countries and territories, with total newly registered capital reaching 12.39 billion USD, down slightly by 8.6%.

However, the growing number of projects reflects continued investor confidence, especially from small- and medium-sized enterprises seeking to expand their presence in Vietnam.

For years, Vietnam’s competitive tax incentives and investment-friendly terms have been key in attracting FDI.

After accounting for all incentives, the effective corporate tax rate for many firms stood at around 12.5%, below the 15% global minimum threshold.

However, many multinational corporations with multiple global subsidiaries have taken advantage of tax loopholes and transfer pricing to minimise their tax liabilities.

According to the Ministry of Finance, in 2023, 56% of FDI firms in Vietnam reported losses, a 21% increase from the previous year, even though both revenue and assets rose.

Over 5,000 firms had negative equity, with accumulated losses reaching 908 trillion VND (34.48 billion USD) – a paradox pointing to potential “profit shifting” practices.

Therefore, the global minimum tax policy is expected to have a dual impact: ensuring tax fairness among FDI enterprises and curbing base erosion, even if it slightly affects future FDI inflows.

For affected investors, the Vietnamese tax authorities will collect a top-up tax to bring their total tax burden to at least 15%.

According to Dr. Le Quang Minh of the University of Economics, Vietnam National University – Hanoi, the policy helps create a level playing field in global investment competition.

By reducing the advantages of “tax havens,” countries must now compete on sustainable factors such as governance, human capital, and innovation capacity, rather than low tax rates.

This shift will further enhance Vietnam’s reputation as a transparent and fair investment destination.

Minh added that the new tax framework helps Vietnam redefine its competitive edge through higher-quality factors – a favourable business environment, skilled workforce, advanced infrastructure, and political stability. The policy not only increases state revenue but also strengthens tax sovereignty.

He noted that FDI relying purely on tax incentives may decline, while strategic investors focused on efficiency, innovation capacity, and workforce quality will find Vietnam increasingly attractive.

Capital flows are expected to shift toward high-tech industries, R&D, and green production, consistent with Vietnam’s sustainable development goals.

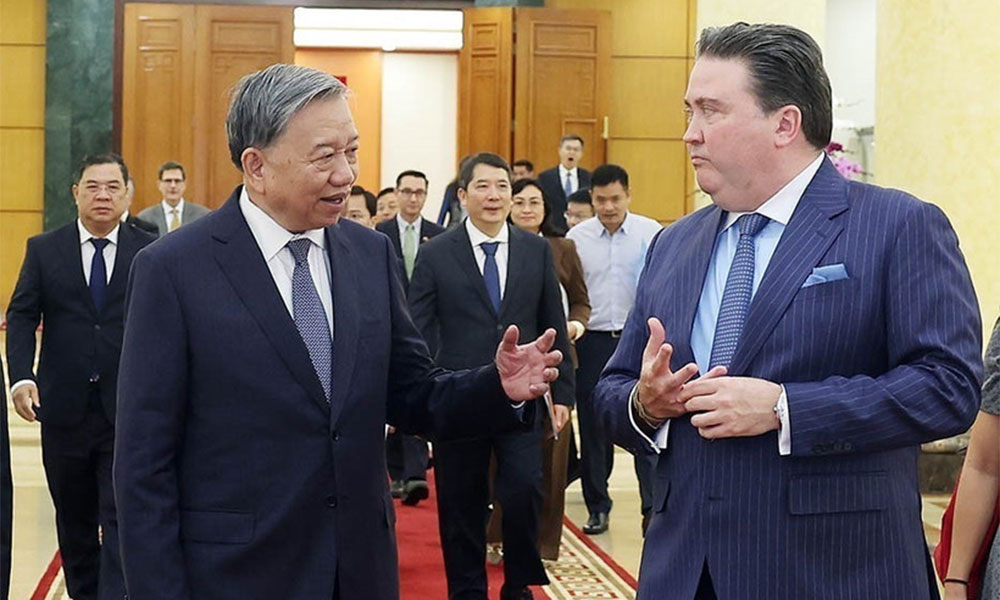

Alexander Ziehe, Chairman of the German Business Association in Vietnam, commended the country’s efforts to modernise infrastructure and promote a transparent investment environment, believing these efforts will continue to attract long-term, high-quality FDI, particularly in sectors where businesses have strong capabilities.

At recent meetings with FDI investors, Deputy Prime Minister Nguyen Chi Dung reaffirmed that Vietnam pursues a selective FDI attraction policy, prioritising projects in strategic infrastructure, science and technology, innovation, digital transformation, biotechnology, new materials, semiconductors, and artificial intelligence.

The Government remains committed to creating favourable conditions and standing side by side with international partners and investors to promote effective and sustainable investment cooperation, Dung stressed.

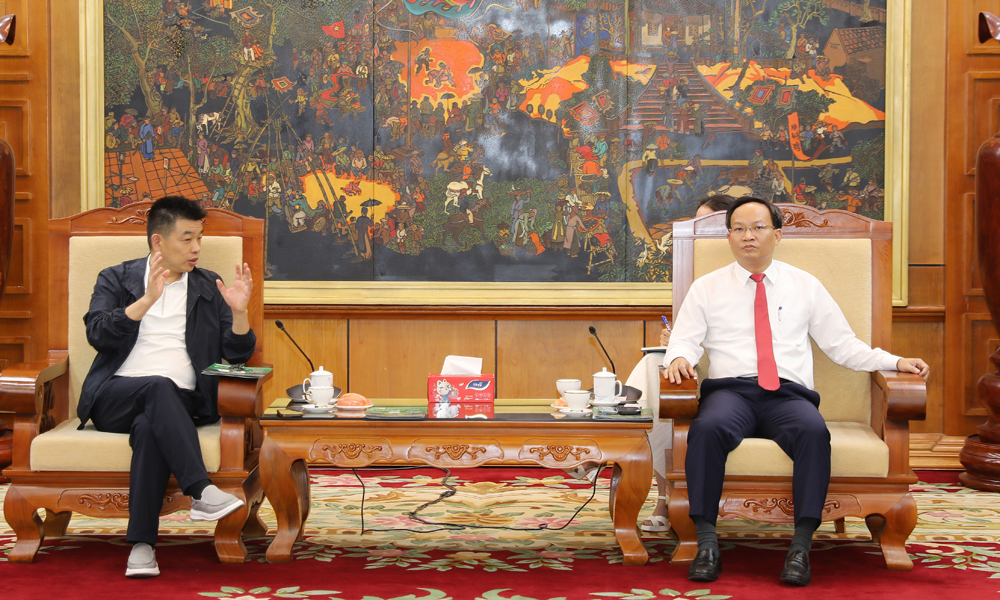

Bắc Ninh

Bắc Ninh

Reader's comments (0)