Vietnam enhances dialogue on tax, customs policies with Korean businesses

Ambassador of the RoK to Vietnam Choi Young Sam highlighted that the tax and customs dialogue, launched in 2008, has served as a valuable platform for the Vietnamese Government and Korean enterprises to directly discuss difficulties and propose policy improvements.

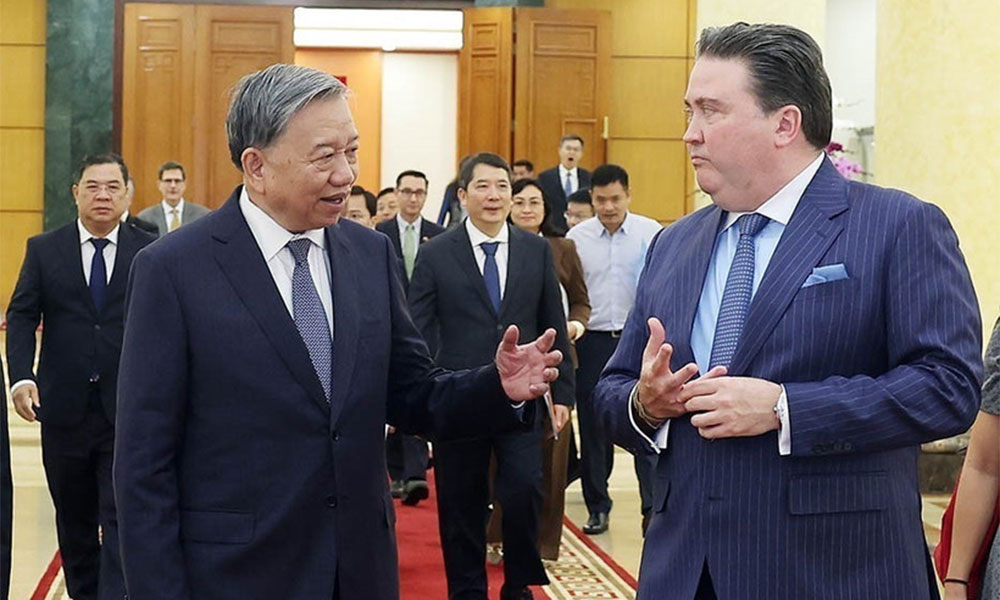

A conference was held on September 30 to strengthen dialogue and promptly address concerns related to tax and customs policies among Korean enterprises in Vietnam, reaffirming the Ministry of Finance (MoF)’s commitment to supporting the foreign-invested business community.

|

|

A conference on strengthening dialogue and promptly addressing concerns related to tax and customs policies among Korean enterprises in Vietnam. |

The event, gathering about 50 Korean businesses operating in Vietnam, also offered updated and accurate information about newly issued regulations on taxation and customs, enabling enterprises to better comply with laws while safeguarding their rights and legitimate interests.

It also contributed to improving the investment climate, encouraging sustainable business practices, and further consolidating the Vietnam – Republic of Korea Comprehensive Strategic Partnership, especially in the fields of economy, trade, and investment.

Ambassador of the RoK to Vietnam Choi Young Sam highlighted that the tax and customs dialogue, launched in 2008, has served as a valuable platform for the Vietnamese Government and Korean enterprises to directly discuss difficulties and propose policy improvements.

He expressed his hope that the dialogue would help foster a transparent, stable, and open tax environment, thereby encouraging new and expanded investments and facilitating honest and convenient tax declarations by Korean firms in Vietnam.

Deputy Minister of Finance Cao Anh Tuan underlined the ministry’s consistent support for businesses, including those from the RoK.

He said that given the unpredictable global economic landscape in 2025, the MoF swiftly proposed to competent authorities a package of support measures on taxes, fees, charges, and land rents worth about 241.74 trillion VND (9.14 billion USD) which has been implemented since early 2025.

In taxation, the MoF has advanced digital transformation and administrative reforms.

Key initiatives include expanding eTax services for businesses, launching the eTax Mobile app for individuals, and applying an automated personal income tax refund system since April 2025.

The ministry is also adopting new technologies such as AI and big data to tax administration.

In customs, digital transformation and administrative reforms are being further promoted to ensure smoother and more efficient services for both citizens and businesses.

At the event, representatives from the departments of taxation and customs and other MoF units presented recent achievements, particularly administrative reforms and new legal documents issued since March 2024.

The MoF called on Korean enterprises in Vietnam to seize opportunities to step up innovation, strengthen competitiveness, and grow sustainably while seriously complying with tax and customs laws and contributing to Vietnam’s socio-economic development.

The RoK is one of Vietnam’s largest foreign investors. As of early 2025, its total registered investment in Vietnam had exceeded 92 billion USD across more than 10,000 projects in manufacturing, trade, and services, playing an important role in Vietnam’s export activities and contributing significantly to the national economy, according to the MoF.

Bắc Ninh

Bắc Ninh

Reader's comments (0)