Bac Giang: E-tax payments benefit both firms, taxation sector

Updated: 11:04, 26/12/2016

(BGO) – The taxation sector of the northern Bac Giang province has strived to fulfill three targets of 95 percent of local enterprises registering for e-tax payments, number of tax payment transactions and amount of tax payments in 2016.

|

|

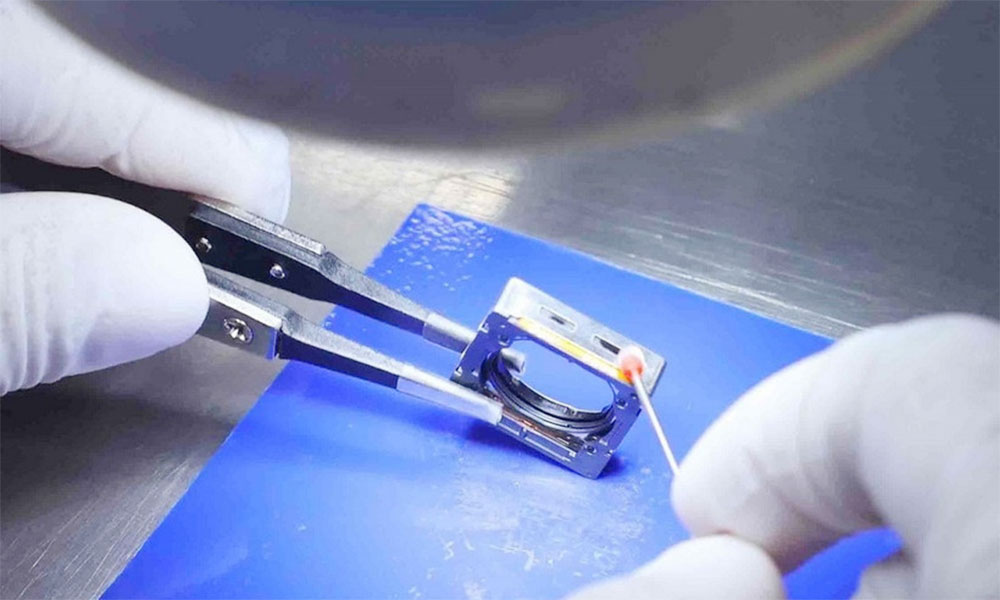

An official of the ICT Division of the provincial Department of Taxation provides assistance for tax payers. |

Pay taxes with a mouse click

Previously, Nguyen Thi Thuy Linh, an accountant of the Ha Bac Petroleum Service Trading Company, had to fill in the taxation statements, print them out and submit to the “One-stop” division of the local taxation office, and then went to a commercial bank or local treasury office to pay her company’s taxes.

During busy time, she had to line up for all these procedures, which took a lot of time. Now with e-tax payment services, Linh can stay at home, implement e-tax declarations and payments via her internet-connected computer. “E-tax payments help me to save papers, time and energy”, Linh said.

E-tax payments have proven their effectiveness and convenience. Enterprise accountants can work on the procedures anytime, anywhere with internet connection and receive commercial banks’ confirmation right after their payments are made. Moreover, relevant documents available on the information portal also help enterprises save papers and time to print them out and store.

|

"To implement the administrative reform roadmap of the General Department of Taxation under the Ministry of Finance, the Bac Giang Department of Taxation has accelerated the application of information and communication technology (ICT) in tax management, while providing assistance for tax payers". Le Huu Nam, Deputy Director of Bac Giang Taxation Department |

By the end of September 2016, as many as 3,620 local firms had registered for e-tax payments, accounting for 98.16 percent of the total number. Up to 95.01 percent of them have successfully completed e-tax payments.

To achieve more comprehensive and effective implementation

In order to achieve these positive remarks and figures, the province’s taxation sector has taken numerous efforts to speed up ICT application in combination with administrative reform in accordance with instructions of the Government, the Finance Ministry, the General Department of Taxation, and the provincial People’s Committee.

Accordingly, the provincial Department of Taxation has invested in upgrading ICT infrastructure and software serving the implementation of e-tax payments.

Work teams have been set up to instruct over 3,000 local enterprises to use the service. All other relevant bodies and individuals have also joined the campaign to accelerate e-tax payments across local firms.

The sector has also worked with the Vietnam State Treasury and local branches of commercial banks, such as BIDV, Vietinbank, Agribank, Vietcombank, MB bank to assist firms to register for the service.

However, a number of local firms haven’t been interested in the service, particularly small and super-small ones, which are not equipped with internet-connected computers and their accountants have low ICT skills and knowledge. Some of them event don’t have enough balance in their bank accounts to pay taxes online. Others show their concern over security and safety to use this method.

Besides, enterprises have also encountered other challenges in using the service, such as high transaction costs, internet overload during peak time and technical problems.

Bao Khanh

Bắc Ninh

Bắc Ninh

Reader's comments (0)