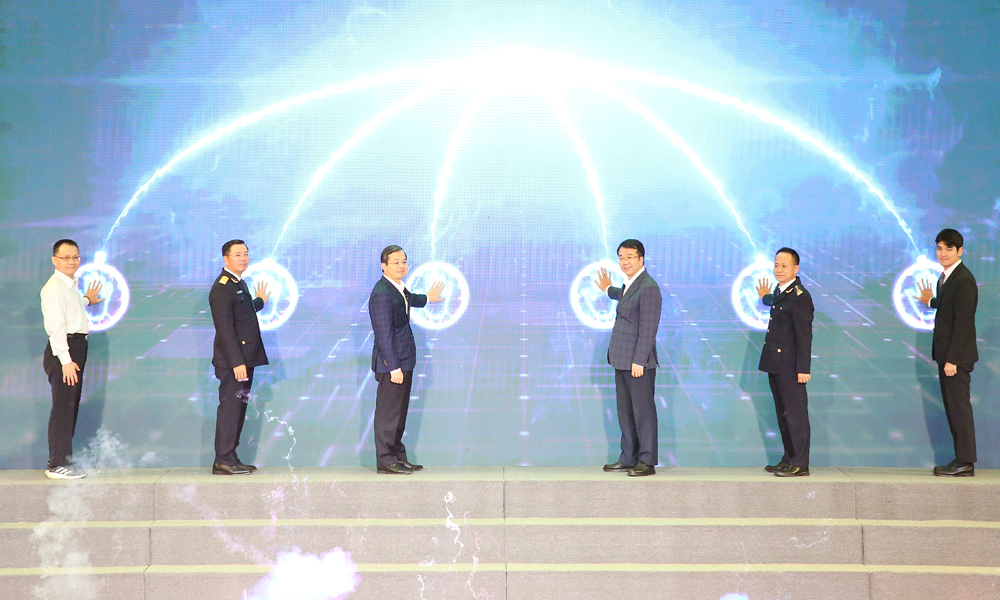

2025 cashless payment value nearly 28 times GDP

The number and value of cashless payment transactions in Vietnam rose by an average of 58.86% and 24.36% a year over the past five years.

The 2025 cashless payment value in Vietnam was estimated at about 28 times the country’s GDP, far exceeding Government targets, according to a report released by the State Bank of Vietnam (SBV) on February 2.

|

|

QR code transactions increased by 106.24% in volume and 128.15% in value. |

In its review of the Government’s project on the development of cashless payments for the 2021–25 period, the SBV said the number and value of cashless payment transactions rose by an average of 58.86% and 24.36% a year over the past five years.

Specifically, transactions via the internet channel increased by 60.6% a year in number and 31.92% in value, while mobile phone transactions climbed by 73.32% in volume and 52.55% in value. QR code payments recorded the fastest growth, surging by 106.24% in volume and 128.15% in value.

By December 2025, the number of individual payment accounts had exceeded 232 million, up 13.68% compared with the same period in 2024.

The number of bank cards in circulation surpassed 164 million by December 2025, marking a rise of 5.32% year on year.

During the 2021–2025 period, domestic card transactions increased by an average of 13.9% per year, while transaction value grew by 12.08% annually.

By the end of 2025, the number of ATMs had fallen by 1.09% compared with 2024, while the number of POS terminals rose by 19.86%. In 2025 alone, ATM transactions declined by 17.30% in number and 6.02% in value compared with the previous year.

Bắc Ninh

Bắc Ninh

Reader's comments (0)