Vietnamese textile industry focuses on higher value, export growth

To remain globally competitive, Vietnamese garment and textile producers must increase productivity, invest in modern equipment and automation, diversify product lines, and expand into high-end, specialised markets.

As Vietnam’s textile and garment exports continue to grow, companies are increasingly focusing on boosting productivity and adding value to their products, investing in smart factories and streamlining operations to enhance efficiency and competitiveness in the global market.

|

|

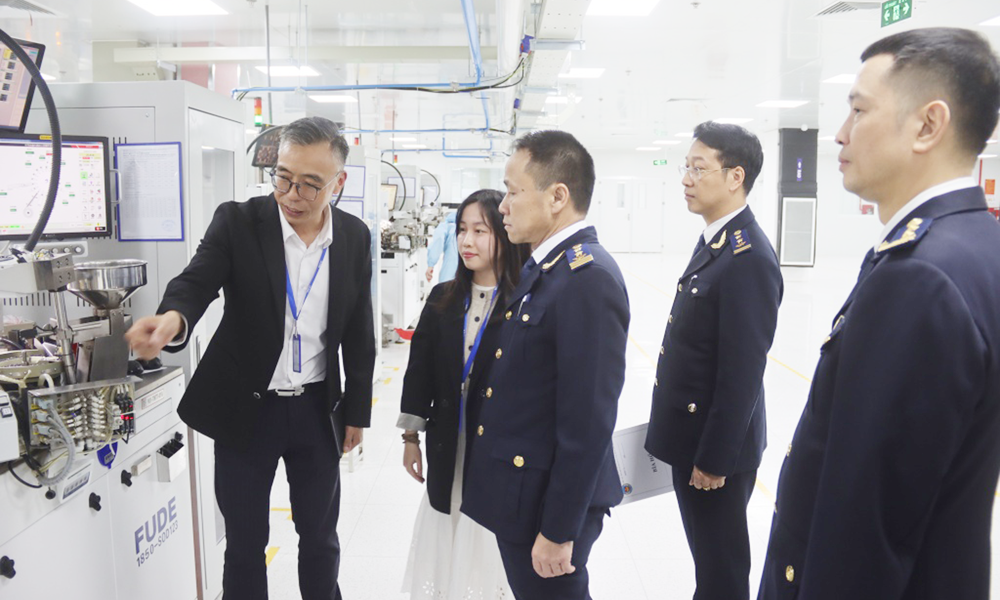

Illustrative image. |

The sector recorded nearly 34.8 billion USD in export value in the first nine months of 2025, up 7.7% from the same period last year, despite challenging global market conditions. This performance sets the stage for the sector to achieve its full-year export target of 48 billion USD.

Many enterprises have confirmed orders through November and are negotiating those for the final months of the year.

Nguyen Ngoc Binh, CEO of Hoa Tho Textile Corporation, noted that market volatility has required measures to stabilise production and maintain exports.

The company achieved over 4.2 trillion VND (nearly 160 million USD) in revenue over nine months, 83% of its annual plan, with a pre-tax profit of 329 billion VND, or 91% of the target.

To meet year-end goals, the company plans to optimise equipment and labour efficiency, improve product quality, and align production with market demand while preparing model smart factories for the future.

Binh highlighted pressures from global supply and demand fluctuations. For instance, the US market is expected to see lower consumption due to rising consumer prices, while the EU and Japanese markets increasingly demand green-certified products.

Rising minimum wages in 2026 will also affect labour costs, prompting firms to invest in workforce training, welfare improvements, and automation.

Than Duc Viet, CEO of May 10 Corporation, reported 104% of its revenue plan after nine months, driven mainly by exports, but noted pressures from declining order volumes, low unit prices, and geopolitical uncertainties.

Vinatex CEO Cao Huu Hieu added that US retaliatory tariffs have reduced orders by 20-30%, highlighting risks for companies, as the US accounts for over 40% of Vietnam’s garment exports.

Boosting position in global supply chain

Despite challenges, Vinatex reported 14.5 trillion VND in revenue in the nine-month period, reaching 79% of its annual plan, and 1.04 trillion VND in pre-tax profit, exceeding the target by 14% and doubling the figure in the same period last year. Flexible strategies and close market monitoring helped the company achieve these results.

Among the total garment and textile export value of 34.8 billion USD, garments fetched 27.8 billion USD and the remaining came from other products such as fabrics, yarn, and technical textiles.

The sector has benefited from its presence in nearly 140 countries, supporting continued growth, especially during peak seasonal demand.

However, the industry remains highly dependent on imported raw materials, particularly from China, with cotton entirely imported and fibre largely sourced abroad. Most firms focus on processing and have yet to develop higher value-added stages such as design, branding, and distribution.

To remain competitive, enterprises must increase productivity, invest in modern equipment and automation, diversify product lines, and expand into high-end, specialised markets.

Developing domestic raw material sources, product development centres, and integrated industrial zones will strengthen Vietnam’s position in the global textile and garment supply chain.

Bắc Ninh

Bắc Ninh

Reader's comments (0)