Vietnam plans green loan boost for eco-friendly projects

A fixed 2% annual interest rate subsidy is proposed for the private enterprises, business households and individuals on loans for green, circular economy and environmental – social – governance (ESG) projects, accroding a a draft decree by the State Bank of Vietnam.

Going green just got easier. A fixed 2% annual interest rate subsidy is being proposed for private enterprises, business households and individuals taking out loans for green, circular economy and environmental-social-governance (ESG) projects, according to a draft decree by the State Bank of Vietnam.

|

|

Green credit has expanded steadily with outstanding loans reaching 730 trillion VND (431 billion USD) as of the end of June, up 7.35% from the end of 2024. |

The decree, currently under review, is aimed at reducing capital costs, boosting cash flow and accelerating the country’s green transition towards the net-zero target by 2050.

Eligible borrowers include private enterprises, households and individuals undertaking projects verified as green, circular or compliant with ESG standards.

The Ministry of Agriculture and Environment will be responsible for certifying projects and publishing approved lists on its e-portal.

State Bank statistics show that green credit has expanded steadily, with outstanding loans reaching 730 trillion VND (31 billion USD) as of the end of June, up 7.35% from the end of 2024 and accounting for 4.3% of total outstanding loans in the economy. Green credit growth averaged 21.2% in the 2017–24 period, outpacing overall credit growth.

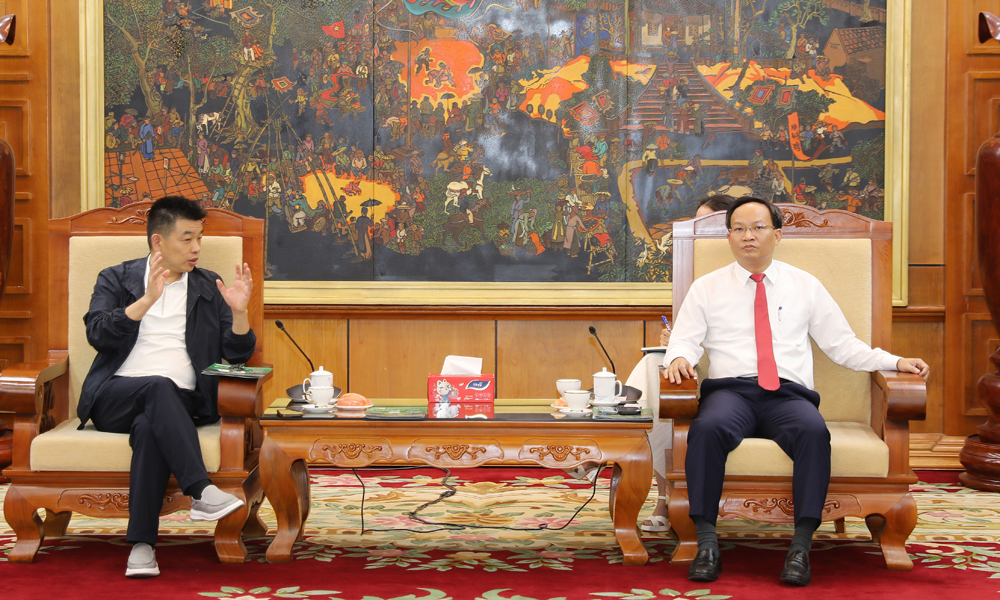

Bắc Ninh

Bắc Ninh

.jpg)

Reader's comments (0)